When a development reaches practical completion, many assume the funding journey is over. But for experienced UK developers, that’s often where the next opportunity begins — and increasingly, lenders are being asked a key question:

Can you raise capital on the built value of your project, even before all units are sold?

The short answer? Yes – through a type of Dev-Exit funding that relies on the strength of the built asset, not just the realised sales.

Understanding Built Value vs Sales Value

Traditionally, lenders assess loan amounts based on either:

- Open Market Value (OMV): what individual units are expected to fetch

- Gross Development Value (GDV): the total projected value of the development at sale

But post-completion, a third concept enters: Built Value – a lender’s view of the finished project’s value as a whole, either as a block sale or income-generating asset. This is often lower than GDV but higher than fire-sale valuation.

Built Value becomes relevant when units are unsold, reserved, or not yet listed – but the asset is fully developed and ready for occupation.

Why This Matters for Developers

Raising funds on built value can unlock equity for:

- Securing the next site

- Funding early-stage planning work

- Releasing retained profit to investors

This approach allows developers to avoid rushed sales or distressed refinancing while maintaining momentum across their pipeline.

According to HM Land Registry data, new build average prices in England (as of early 2025) remain ~18% higher than existing stock. Yet sales cycles have slowed down slightly in key regions – meaning time, not product, is the bottleneck. This is where Dev-Exit funding on built value offers breathing space.

When Lenders May Fund Against Built Value

Lenders will typically consider built value as a security base when:

- The scheme is 100% complete (signed off to Building Control)

- The borrower has a clear exit strategy (e.g. sales, refinance, or PRS disposal)

- Planning conditions have been discharged

- Units are market-ready or partially reserved

- There’s evidence of historic or pipeline sales at/near asking price

In this case, the lender may commission a valuation based on investment or comparable analysis, not just sold prices.

Loan Structure and Risk Profile

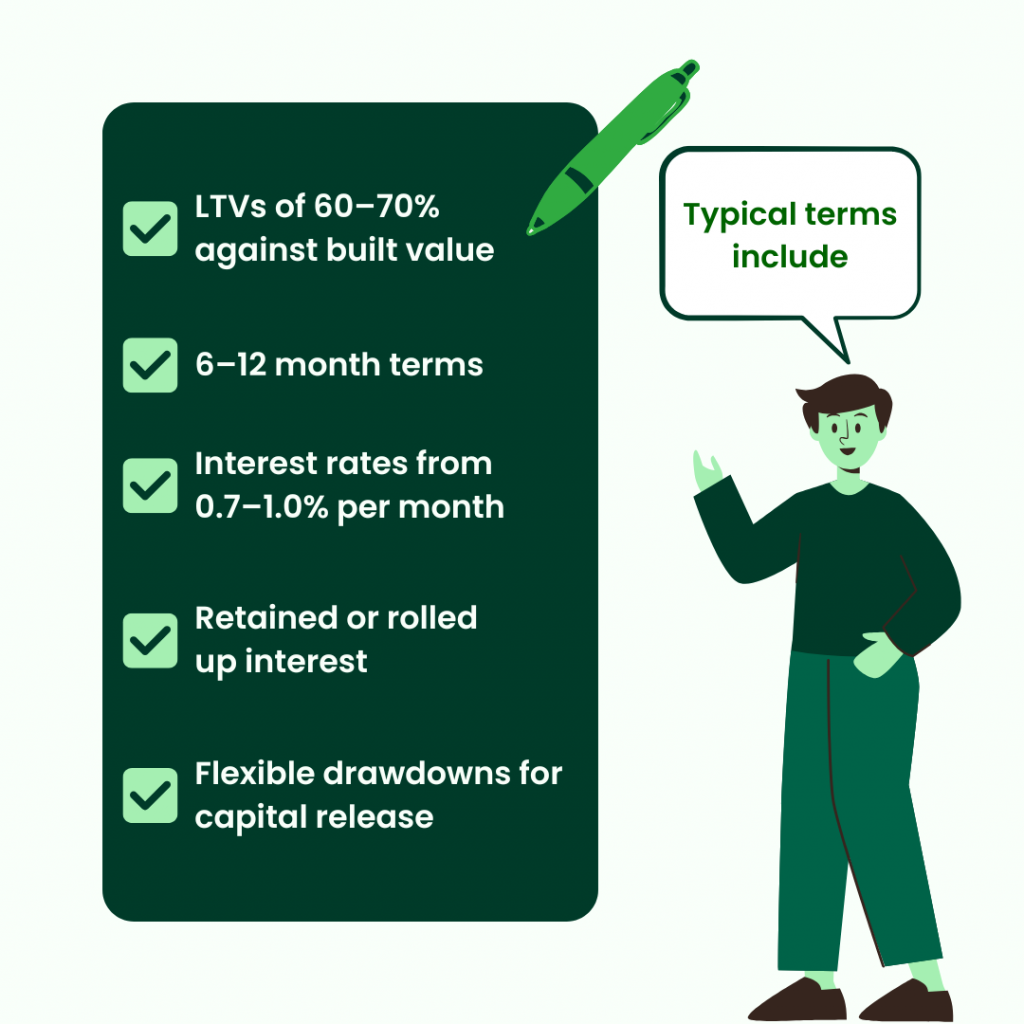

Typical terms include:

- LTVs of 60–70% against built value

- 6–12 month terms

- Interest rates from 0.7–1.0% per month

- Retained or rolled up interest

- Flexible drawdowns for capital release

Final Thought: Built Assets, Built Finance

Lending against built value is a pragmatic response to real market conditions. It recognises that a finished scheme is a valuable asset – even before the cash is in the bank from every sale.

For developers looking to release equity without undermining sales strategy, Dev-Exit Funding based on built value offers the flexibility to build forward – not just look back.