Bridging loans have become an essential financial tool for those looking to secure quick funding, particularly in property transactions which are offered via auctions, have a defined completion timeline by the seller, or are not yet ready for a term loan. These loans are usually short-term, with tenures of less than 2 years helping bridge financial needs before a long-term financing solution can be arranged. If you are looking for a reliable bridging loan provider, bborroww.com offers tailored solutions to suit your financial needs.

In this article, we break down what a bridging loan is, how it works, and when it might be the right choice.

What is a Bridging Loan?

A bridging loan is a short-term secured loan designed to provide quick capital, often used in property purchases, renovations and developments. Unlike term mortgages, which can take several months to be approved, bridging loans can be arranged in days, making them a popular choice for investors, homebuyers, and developers.

Bridging loans are secured against property, which means borrowers risk losing their equity in the asset if they fail to repay. These loans are generally used for periods ranging from a few months up to 2 years and are when an asset is refinanced to a term loan or is sold. BBorroww.com specializes in flexible and fast bridging loan solutions for individuals and businesses.

How Does a Bridging Loan Work?

- Bridging loans operate by providing a lump sum to borrowers who need short-term capital. They are commonly used for:

- Buying properties at auction, where immediate payment is required.

- Renovating properties before securing a mortgage.

- Development opportunity properties.

- Business cash flow support for companies leveraging real estate assets.

The loan amount depends on the property’s value and the borrower’s ability to provide a repayment strategy (exit plan). The maximum Loan-to-Value (LTV) ratio is typically around 75%.

There are two types of bridging loans:

- Closed Bridging Loans – Have a fixed repayment date and are usually given to borrowers with a guaranteed exit strategy (e.g., contracts exchanged for a property sale).

- Open Bridging Loans – No fixed repayment date, but usually must be repaid within a year. Lenders require a strong exit plan.

First vs. Second Charge Bridging Loans

Lenders place a charge on the property when issuing a bridging loan. This determines the order in which debts are repaid in case of default:

First Charge Bridging Loan: The lender is the first in line to be repaid (e.g., when no mortgage exists, or the loan replaces an existing mortgage).

Second Charge Bridging Loan: If a mortgage is already on the property, the bridging loan is repaid only after the primary mortgage.

Second charge loans usually have higher interest rates because they carry greater risk for the lender.

Costs and Interest Rates

Bridging loans are priced on a monthly interest rate rather than an annual percentage rate (APR), as they are short-term products. The interest rates typically range from 0.8% to 1.6% per calendar month depending on the lender, property type, and borrower profile. This means an annual equivalent rate could be 10% to 20%.

Additional costs include:

- Arrangement Fees: Typically 2-3% of the loan amount.

- Exit Fees: Some lenders charge a fee upon loan repayment.

- Legal and Valuation Fees: Required for processing the loan and securing the asset.

Due to these costs, bridging loans should only be used when absolutely necessary and with a clear repayment plan. BBorroww.com provides transparent pricing with no hidden fees.

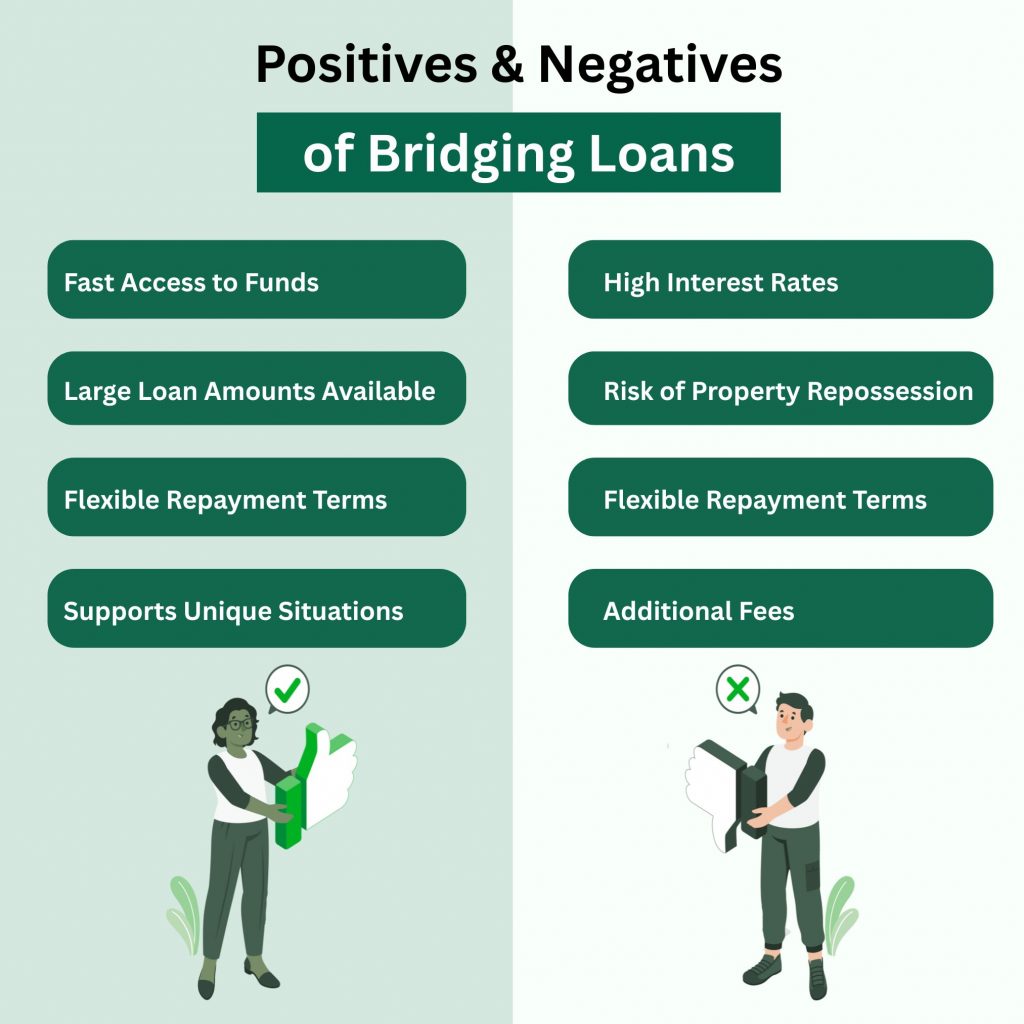

Positives and Negatives of Bridging Loans

Positives:

✔ Fast Access to Funds – Unlike traditional mortgages, bridging loans can be approved within days.

✔ Flexible Repayment Terms – No monthly repayments in many cases; interest can be rolled up and paid at the end.

✔ Large Loan Amounts Available – Borrowers can secure millions depending on property value.

✔ Supports Unique Situations – Helps buyers who need fast funding, such as property developers and auction purchases.

Negatives:

✖ High Interest Rates – More expensive than traditional mortgages.

✖ Risk of Property Repossession – If repayments are not met, the lender can take possession of the secured asset.

✖ Additional Fees – Valuation, legal, and arrangement fees add to the overall cost.

How to Apply for a Bridging Loan

Unlike conventional mortgages, bridging loans are typically not offered by high street banks. Instead, specialist lenders offer them via brokers. BBorroww.com simplifies the process with expert guidance and fast approvals.

Here’s how to apply:

- Determine the Loan Amount and Purpose – Clearly define why you need the loan and how much is required.

- Prepare Your Exit Strategy – Lenders require a solid plan on how the loan will be repaid (e.g., property sale, refinancing, inheritance).

- Get a Property Valuation – The lender will assess the property being used as security.

- Submit Application to a Bridging Loan Provider – A broker can help find the best deal.

- Legal and Underwriting Process – Once approved, legal work is completed, and funds are released.

Current Trends and Future of Bridging Loans in the UK

Bridging loans have grown in popularity in recent years, driven by the competitive UK property market and stricter mortgage lending criteria. In 2024, the market saw an increase in demand due to rising house prices and delays in traditional mortgage approvals.

Looking ahead to 2025, the sector is expected to continue expanding as property investors and homeowners seek alternative financing solutions. Regulatory developments may also shape lending criteria, making it essential for borrowers to stay informed. BBorroww.com stays ahead of market trends, offering flexible and tailored bridging loan solutions for various financial needs.

Final Thoughts

Bridging loans can be an excellent short-term financial tool when used correctly. However, they are high-risk and expensive compared to traditional loans. Before taking one out, borrowers should carefully evaluate their exit strategy and consult with a specialist to ensure they get the best possible terms.

By understanding the mechanics, costs, and risks, you can make an informed decision on whether a bridging loan is the right choice for your needs. Visit BBorroww.com today to explore your options and get expert advice on securing the best bridging loan for your situation.